A few years ago, eight bad guys at Wells Fargo in positions of authority set up false accounts at the bank or had their employees do that. John Stupf was one of them. He made bonus money in the millions. These eight executives helped to set up thousands of frauds that operated by charging people fees for fake accounts, a kind of fraud that strikes down trust and confidence in banking. And now these same bad guys are being fined but not jailed. This is an example of white collar crimes in banking not being criminally prosecuted. Those bad guys probably have money stashed in off shore accounts. Why aren’t they in jail? What about all the economic and social damage that they caused? What about harms to employees and customers? This is an example of economic violence. I’m disgusted that this is happening. It makes it hard to put money in the bank at all. What a shame.

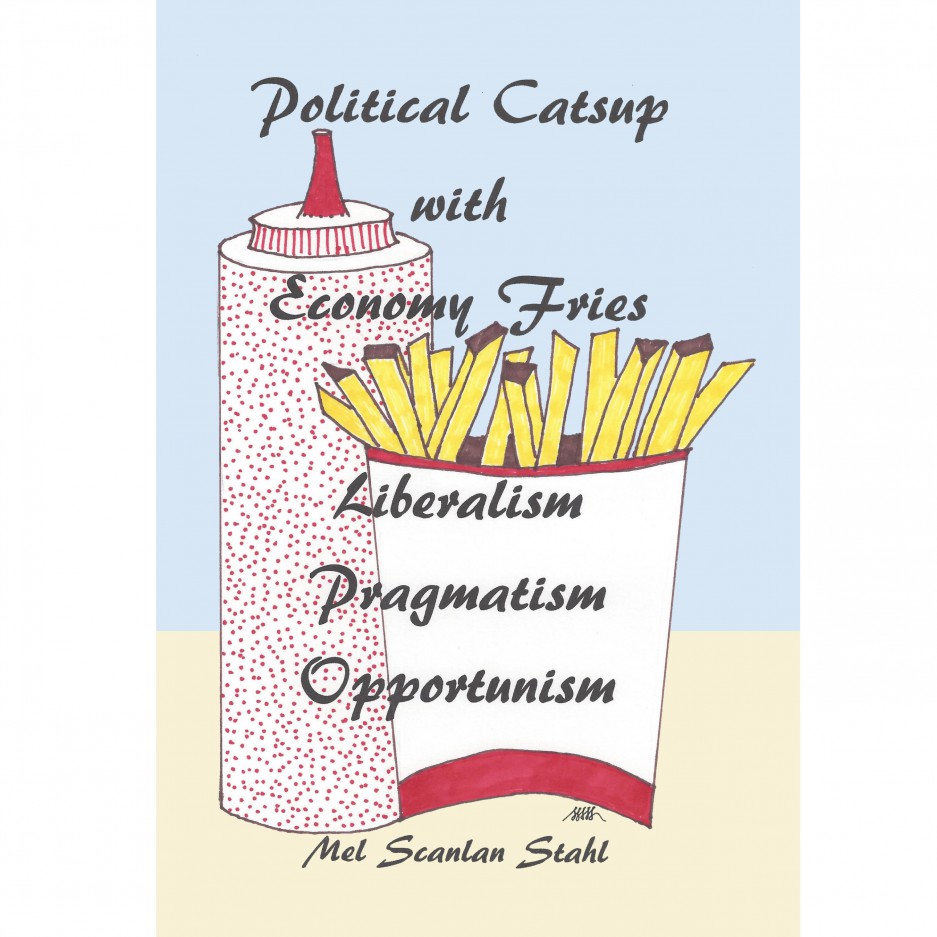

Financialization, ZIRP, TARP, QE, massive borrowing, Derivatives are all destroying the value of our money. A failure to prosecute financial crimes strikes a blow against our society’s order and its ability to reward those that create value. Without a working monetary system, there’s no way to trade or share opportunity. There’s only fraud. If you want to find out more about this kind of travesty and the policies that have caused it, buy a copy of Political Catsup with Economy Fries available at Amazon.com.

Month: January 2020

Monetary policy eclipses all other issues.

Here we are smack dab in the middle of January. I still hear loud squawks about Trump’s impeachment as the press tries to engage us on that topic. The fever pitched press efforts at dramatizing impeachment don’t engage the public when there isn’t a basis to the charges. Most people don’t care about it anymore. After the Russia Hoax there’s little press credibility on Trump matters.

In Virginia, there are clashes of desperados devoted to stopping or enhancing gun regulations but many Americans aren’t really tuning in to that either. Despite Virginia’s Governor’s passionate denial of his voter’s rights according to Virginia statutes and constitutional prerogative, all he deserves is removal from office. The drama of a Civil War isn’t needed now. Natural rights still matter as much as always and the Constitution still offers it’s political wisdom to any who wish to appreciate the document and its guidelines to having a prosperous polity.

These issues pale in comparison to our banking problems. Banking is where politics and economics are bending our reality into its mishapen mess right now. Our monetary policy is failing us.

I would like Americans to pay attention to abuse of our monetary system by the Federal Reserve with all of its ill fated experimentation using derivatives, financialization and cross border capital flows. Also notice off the books expenses by the Pentagon and by private military forces in the Middle East. Notice rampant monetary fraud in Obamacare, Medicare, Medicaid and their attendant price increases in a monopoly market that undermines reasonable price discovery. Notice that despite whatever experts such as Timothy Geithner tell us all to the contrary, TARP, zero interest rate policy and QE failed our nation’s economy and sowed fresh seeds of distrust. American distrust of political organizations and institutions is the rot at the core of our nation’s center. A distrustful nation can’t do as much as a nation that is solvent and accountable.

I would like all Americans to see where capital has been injected into the stock market in order to elevate stock market prices. These injections are undermining real market trading with capital injections and computer trading. I would like all Americans to notice the effects both now and in history to monetary abuses involving graft, involving over-printing capital, involving debt. Look at myriad easy-money disasters that have followed banking deregulation…buyouts, long-term unemployment. Let’s come together in a universal vigil and acknowledge that our leaders are failing us when they make decisions involving our monetary system.

Reform of our monetary system must be undertaken in order to restore a prosperous America. We can start by ending the existence of holding companies. Holding companies were FDR’s honey to assuage the vinegar of the SEC. They were the escape trap door and tunnel out of bankruptcy and financial regulation. The SEC is mostly powerless now, so what do we need holding companies for? They hide the capital holdings of people who abuse their opportunities and allow them to escape bankruptcy with hidden cash reserves. This is cheating. We can also acknowledge that derivatives have to go away. They aren’t really constitutional because they lead to imbalances in the market and cash creation after insolvencies that they cause. We can reduce the size of giant Too-Big-To-Fail banks. We can go back to the earlier regime of Glass Steagall separation of investment and commercial bank holdings. We can start paying interest on bank accounts that encourage savings instead of ripping off savers. We can close the borders of nations to free capital flows which hurt people who have smaller amounts of assets. This greedy dance of wild capital hasn’t freed people as many imagined that it would. It only misallocates resources which are wasted. It destroys opportunities that we all need. If you want to learn more about these topics, buy a copy of Political Catsup with Economy Fries from Amazon.com.